irs tax levy letter

This letter hereby notifies you that we have. It can garnish wages take money in your bank or other financial account seize and sell your.

Irs Audit Letter Cp23 Sample 1

Contact the IRS immediately to resolve your tax liability and request a levy release.

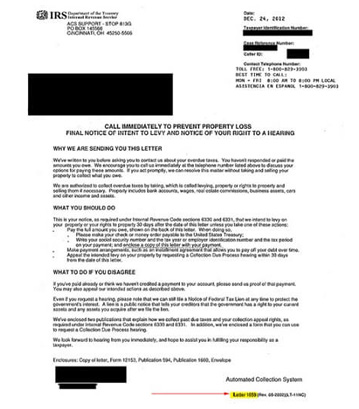

. LT11final notice of intent to levy. Employee Notification of IRS Tax Levy Letter. This is often done by sending you a warning letter in the mail.

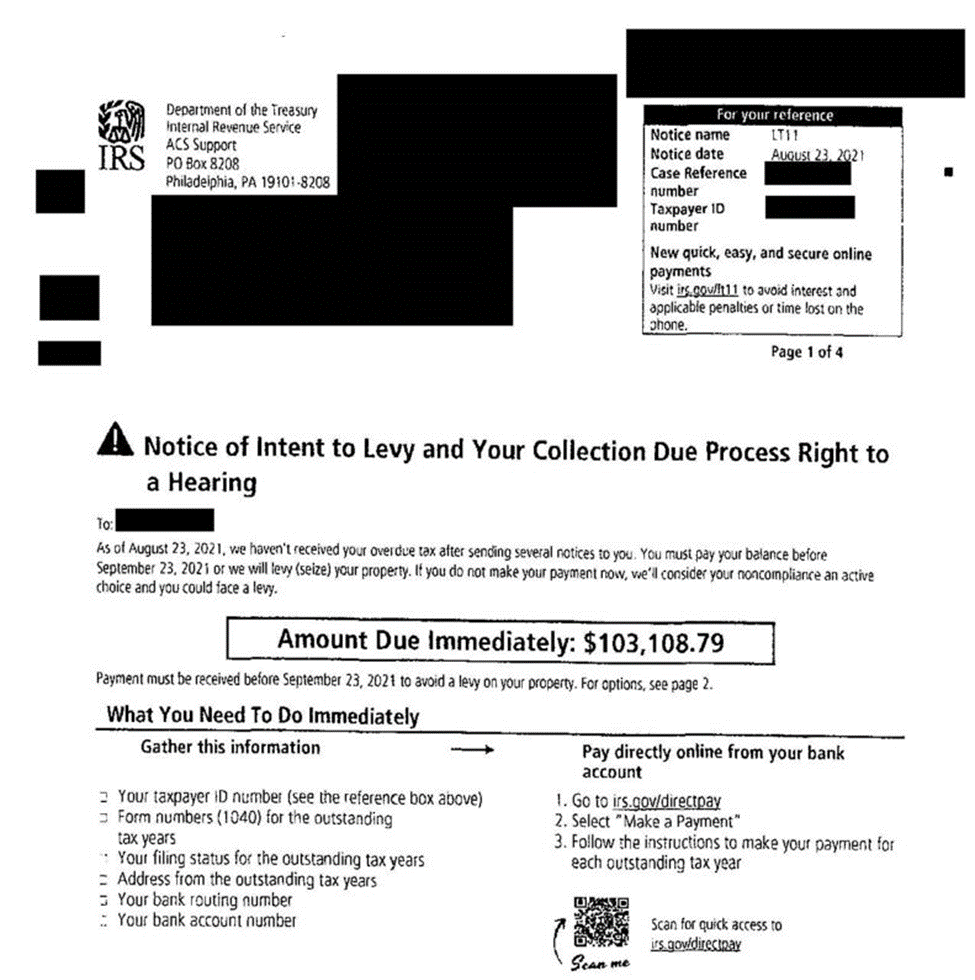

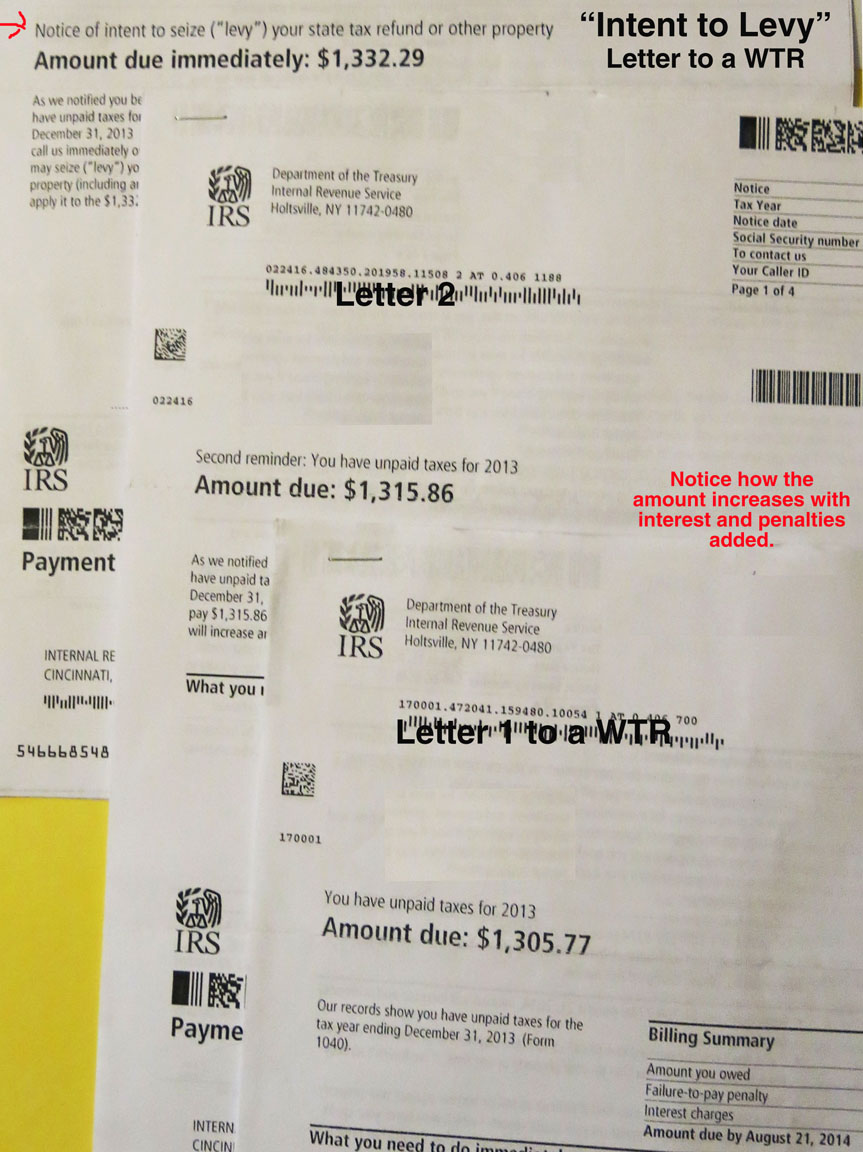

An IRS levy permits the legal seizure of your property to satisfy a tax debt. This is the letter you receive before the IRS levies your assets. There are two types of levy notices the IRS sends via certified mail.

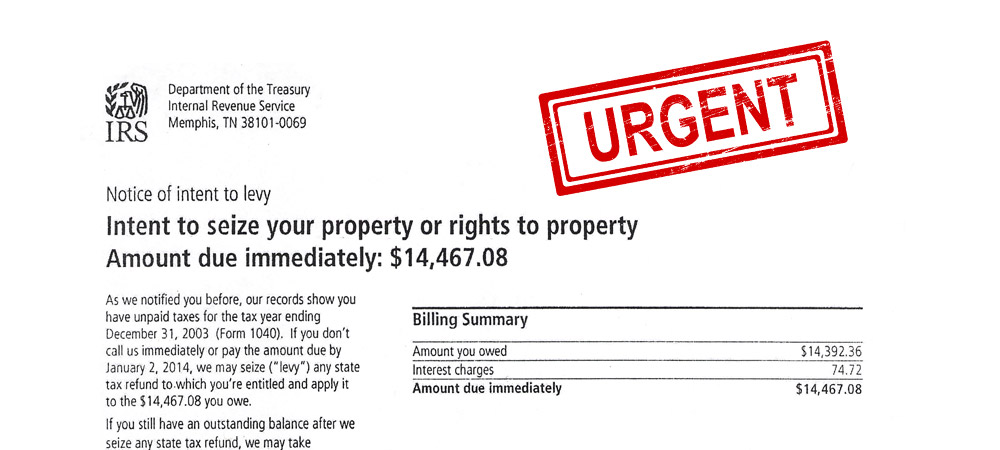

You have a balance on your tax account so the IRS sent you a notice or letter. What this notice is about. The IRS can also release a levy if it determines that the levy is causing.

It is different from a lien while a lien makes a claim to your assets. Even if you think you do not owe the tax bill you should contact the IRS. CP504allows refunds to be seized.

You have an unpaid tax debt and the IRS has issued a levy which is a legal seizure of your property or assets. The notice may tell you that the IRS plans to levy your bank account garnish your wages or seize other assets. You have an unpaid tax debt and the IRS has issued a levy which is a legal seizure of your property or assets.

This letter can be readily identified by looking at the upper right hand corner there you will see the identifiers LT11. Pay your unpaid balance. When you pay your balance in full well stop adding interest and.

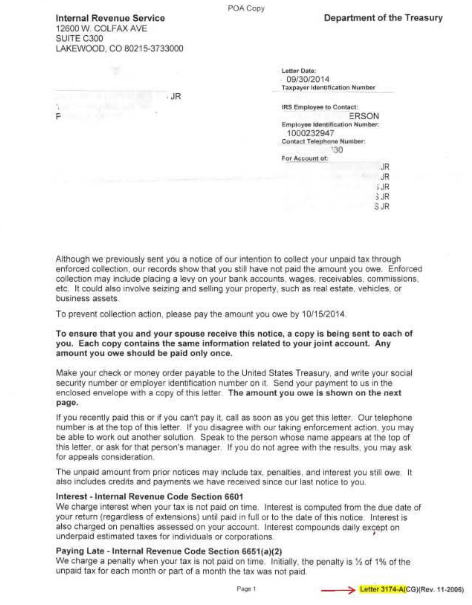

An IRS Notice of Levy is a letter sent to taxpayers who have not paid their back taxes and have an IRS lien placed against them. Tax Exempt Bonds. Letter 3172 Notice of Federal Tax Lien Filing and Your Rights to a Hearing under IRC 6320.

The IRS is required to send you notice of its intention to levy at least 30 calendar days before initiating the levy action. If the IRS still did not hear from you they sent you notice that a Notice of Federal Tax Lien was. This notice is your Notice of Intent to Levy Internal Revenue.

Employees social security number Dear Employee Name. The IRS is notifying the delinquent taxpayer that they will begin. You received this notice because we havent received payment of your unpaid balance.

Notice of Intent to Levy and Notice of Your Right to a Hearing is mailed to taxpayers to notify them of their unpaid taxes and that the IRS intends to levy to collect the. Date Employee Name Address RE. It is different from a lien while a lien makes a claim to your assets as.

It is different from a lien while a lien makes a claim to your assets. Understanding Your LT11 Notice or Letter 1058 Internal Revenue Service. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

This letter is to notify you the IRS filed a notice of tax lien for the unpaid taxes. You have an unpaid tax debt and the IRS has issued a levy which is a legal seizure of your property or assets. It is different from a lien while a lien makes a claim to your assets.

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing. This is the code the IRS puts on the final notice of intent. This certified mail from the IRS is.

Irs Audit Letter Cp14 Sample 1

Irs Form 1058 Notice Of Intent To Levy

Irs Audit Letter Cp22a Sample 1

Irs Letter 2975 Intent To Terminate Installment Agreement H R Block

Irs Notice Lt16 Your Account Has Been Marked For Enforcement Action H R Block

Irs Just Sent Me A Notice Of Intent To Levy Intent To Terminate Your Installment Agreement Cp 523 What Should I Do Legacy Tax Resolution Services

What Is An Irs Levy And How Do I Fight It Tax Defense Ohio

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Did You Receive Irs Notice Lt16 What You Need To Do To Prevent An Irs Levy Tax Attorney Orange County Ca Kahn Tax Law

Irs Letter 3174 What It Means And How To Respond To It Supermoney

Notice Cp504b What It Means How To Respond Paladini Law

Appealing An Irs Tax Levy When And How To Request

Irs Letter 39 Lt39 Reminder Of Overdue Taxes H R Block

5 19 9 Automated Levy Programs Internal Revenue Service

Irs Notice Cp504 Understanding Irs Notice Cp504 Notice Of Intent To Levy Immediate Response Required

Irs Tax Levies Franskoviak Tax Solutions Solving Tax Levy Issues

Irs Collection Notices Cp14 Cp500s 1058 1153 3172 Form 668

More On Irs Collection Tactics National War Tax Resistance Coordinating Committee